Over the past few years, affordability has been one of the biggest hurdles for homebuyers. Between rising home prices and increased mortgage rates, many have felt priced out or unsure of when to make a move.

But there's some good news. While affordability remains tight, mortgage rates have shown signs of leveling off. That shift is giving buyers a chance to plan with more confidence.

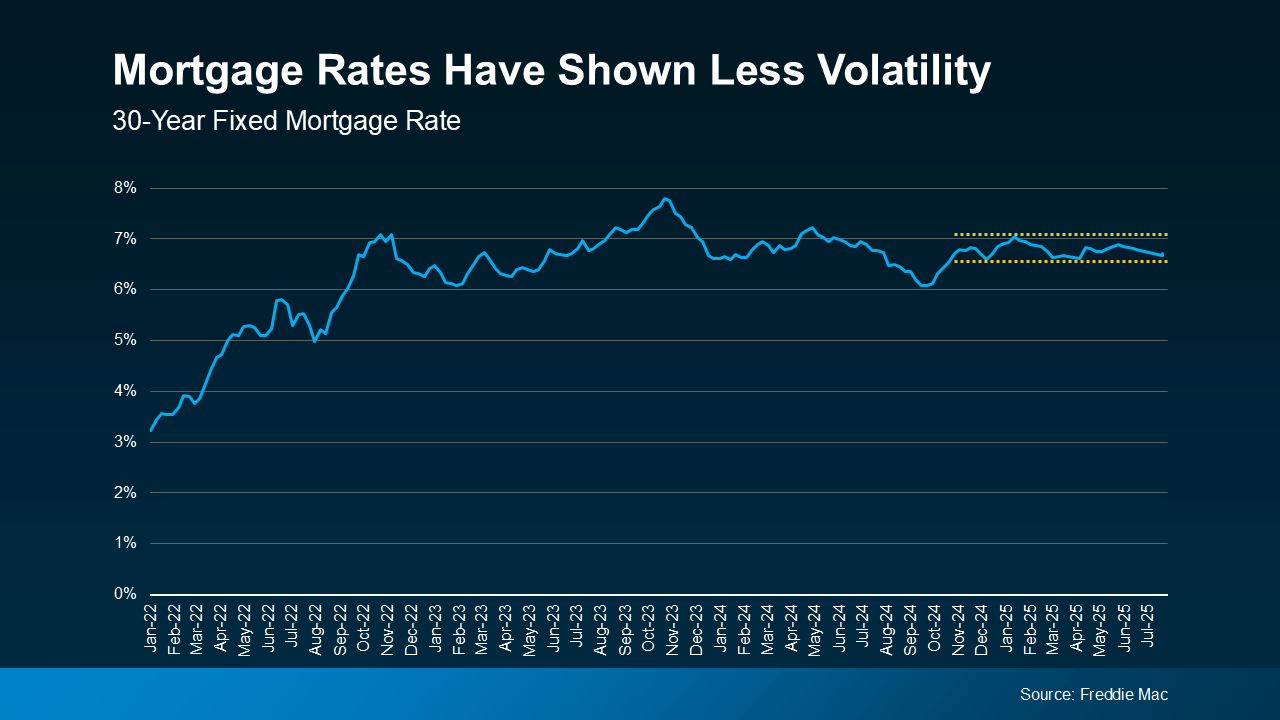

Mortgage Rates Have Stabilized – For Now

Over the past year, mortgage rates have experienced a lot of ups and downs, making it difficult to know what to expect from week to week. But lately, that volatility has eased.

Rates have settled into a more consistent pattern (

see graph below):

As the graph shows, rates have stayed within that half-percentage-point since late last year. Yes, there’s been movement within that range, but wild swings and sudden ups and downs just haven’t been the story lately. And that’s a bigger deal than you may realize. As HousingWire explains:

“Analysts, economists and mortgage professionals are coining this quarter’s activity as one of the most “calm” periods for mortgage rates in recent memory.”

How This Helps Today’s Buyers

Let’s be honest—uncertainty is stressful. When rates spike from one week to the next, it’s hard to feel secure about moving forward with a purchase. The recent stretch of stability offers something valuable: clarity.

Buyers now have a better idea of what their monthly payment might look like, which makes it easier to budget and move forward with less hesitation.

Even if mortgage rates aren’t as low as you'd like, the fact that they’re holding steady makes planning a lot more manageable.

Will This Stability Last?

Experts say this calm might stick around for a while. Rates may decline slightly in the coming months, but changes are expected to be gradual. As Danielle Hale, Chief Economist at Realtor.com, says:

“I expect a generally downward trend for rates this year, but at a slow enough pace that it might not be noticeable in any given month.”

In other words, don’t wait for a massive drop. Trying to time the market could mean missing out on the opportunity right in front of you. As Jeff Ostrowski, Housing Market Analyst at Bankrate, explains:

“Trying to time mortgage rates is really difficult. There’s no guarantee that rates are going to be any more favorable in three months or six months.”

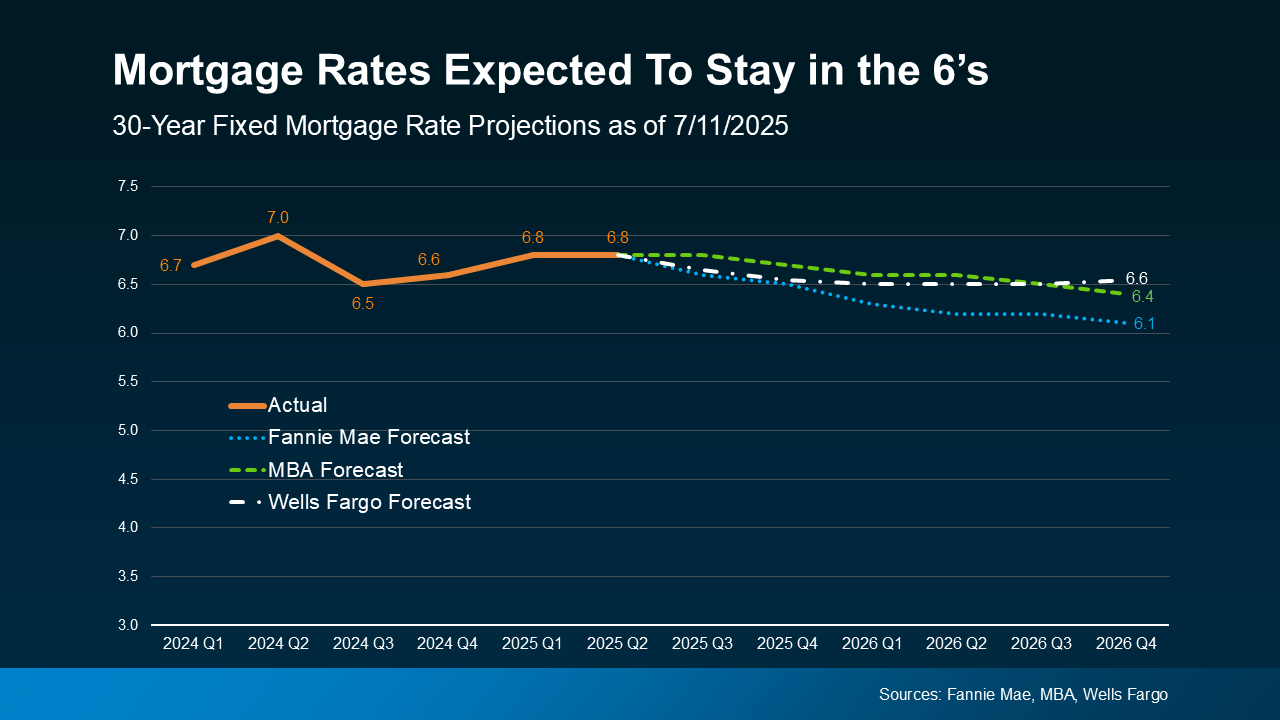

Looking at longer-term

forecasts most experts agree that rates are likely to hover in the

mid-6% range through the end of 2026 (

see graph below):

That’s still within reach for many buyers—and far less unpredictable than what we’ve seen in the past. As Sam Khater, Chief Economist at

Freddie Mac,

explains:

“Mortgage rates have moved within a narrow range for the past few months . . . Rate stability, improving inventory and slower house price growth are an encouraging combination . . .”

Just remember, mortgage rates are still going to react to changing economic conditions, inflation, and more – and that means they could shift again. But right now, you’ve got more predictability, and that means more opportunity, too.

Bottom Line

While affordability is still a challenge, the market may be offering a bit more stability – and that makes planning your next move a lot easier.

Let’s connect if you want to run the numbers and see what a monthly payment would look like in today’s market. That way you can stop waiting and start planning.

The information and opinions in this article are not investment advice. Tim Stice makes no guarantees about accuracy or completeness. Always do your own research and consult a professional before making financial decisions. Tim Stice is not liable for any loss or damage resulting from reliance on this content.

Tim Stice, Broker Realtor | Hawaii Life | Maui, Hawaii | Real Estate Agent