Lately, it feels like everything is getting more expensive—from groceries to gas to rent. That’s inflation at work. And with prices continuing to rise, you may be asking yourself: Is now really the right time to buy a home?

The answer: Yes—and here’s why.

Owning a home can actually help protect you from the effects of inflation, offering both stability and long-term financial gain.

A Fixed-Rate Mortgage = Monthly Payment Stability

One of the biggest advantages of owning a home is locking in your housing payment.

When you buy a home with a fixed-rate mortgage, your monthly principal and interest payments stay the same. That consistency makes budgeting easier, even as other expenses fluctuate.

While property taxes and insurance may change, your base mortgage payment won’t—giving you more control over your financial future.

Renters, however, face rising costs.

Rent prices typically increase year after year, and often rise faster than inflation itself. (see graph below)

That means renters often pay more over time—without gaining anything in return. But as a homeowner with a fixed mortgage, you’re shielded from those unpredictable hikes.

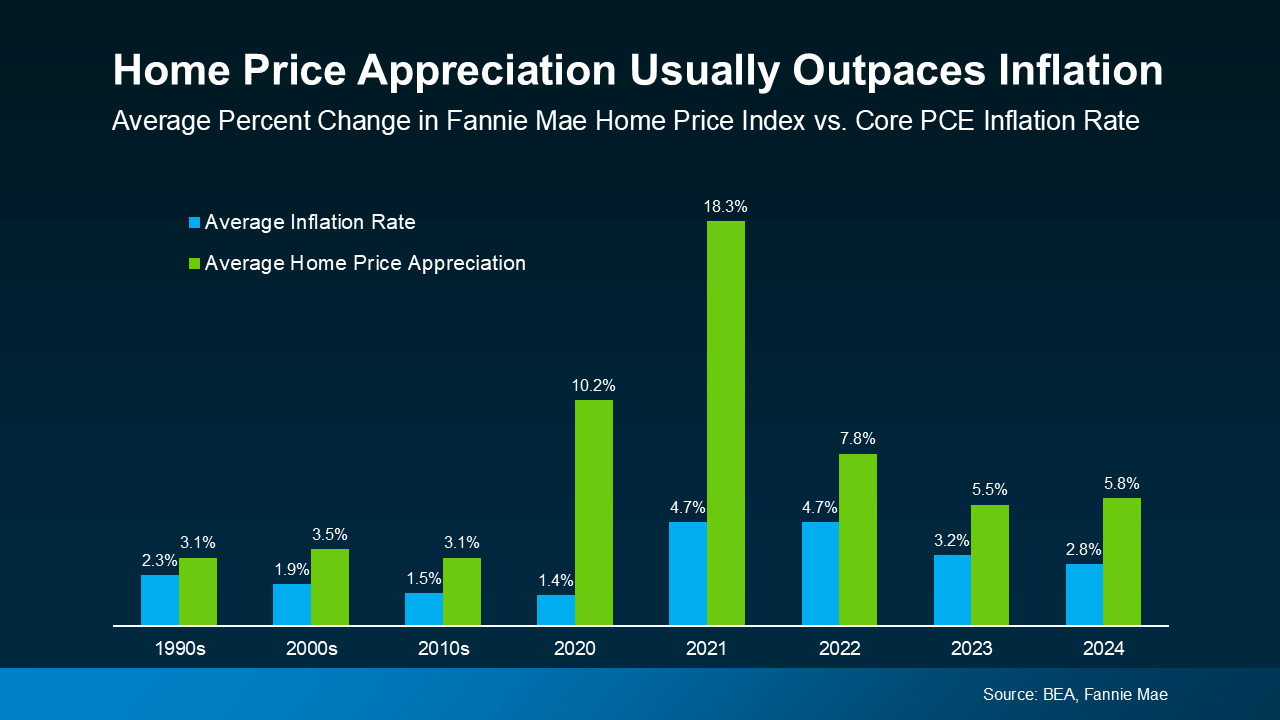

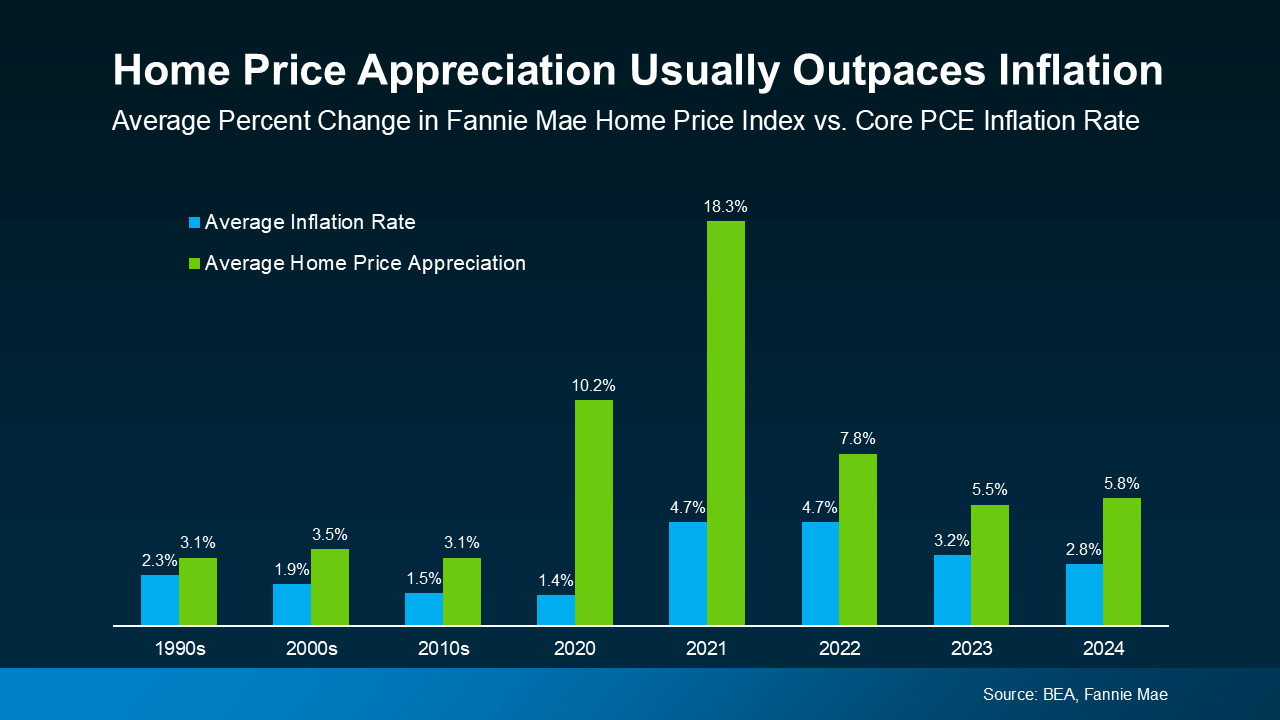

Home Prices Typically Rise Faster Than Inflation

Another reason homeownership is a smart move right now: real estate is a long-term investment that tends to grow in value—often faster than inflation.

Data from the Bureau of Economic Analysis and Fannie Mae backs this up:

While inflation eats away at the value of cash over time, owning property helps you build equity and grow your wealth.

As inflation rises, rent payments go up—but homeowners often see their net worth increase.

Renting vs. Owning in an Inflationary Economy

-

Renters face increasing costs with no financial return

-

Homeowners lock in their largest monthly expense

-

Real estate tends to gain value over time

-

Equity builds as home prices rise

Simply put, owning a home turns rising prices into long-term financial growth, while renting leaves you exposed to inflation with no payoff.

Bottom Line:

Inflation makes everything feel less predictable—but a fixed-rate mortgage offers stability, and rising home values create long-term gains.

If you're worried about rising costs, owning a home could help you take back control of your budget.

What would stable housing costs mean for your financial future? Let’s talk about your options.

The information and opinions in this article are not investment advice. Tim Stice makes no guarantees about accuracy or completeness. Always do your own research and consult a professional before making financial decisions. Tim Stice is not liable for any loss or damage resulting from reliance on this content.

Tim Stice, Broker Realtor | Hawaii Life | Maui, Hawaii | Real Estate Agent