When you’re budgeting to buy a home, you're probably focused on the mortgage rate, purchase price, down payment, and closing costs. But there’s another potential expense that often gets overlooked—homeowners association (HOA) fees.

HOA dues aren’t part of every property, but they’re common in many communities, especially newer ones. Before you fall in love with a home, it’s important to know whether an HOA is involved and how the fees could affect your monthly budget.

What Is an HOA and Why Does It Matter?

Why Do Some Buyers Prefer HOA Communities?

-

Clean, Well-Maintained Neighborhoods: HOAs typically cover services like landscaping, snow removal, and upkeep of shared spaces, which keeps the area attractive.

-

Amenities: Some offer pools, gyms, parks, security patrols, or clubhouses—features that could save you money compared to paying for them individually.

-

Home Value Protection: Rules help prevent neglected or poorly maintained homes, which can help preserve property values.

-

Fewer Responsibilities: In some communities, the HOA handles exterior repairs or roof maintenance, reducing your personal upkeep.

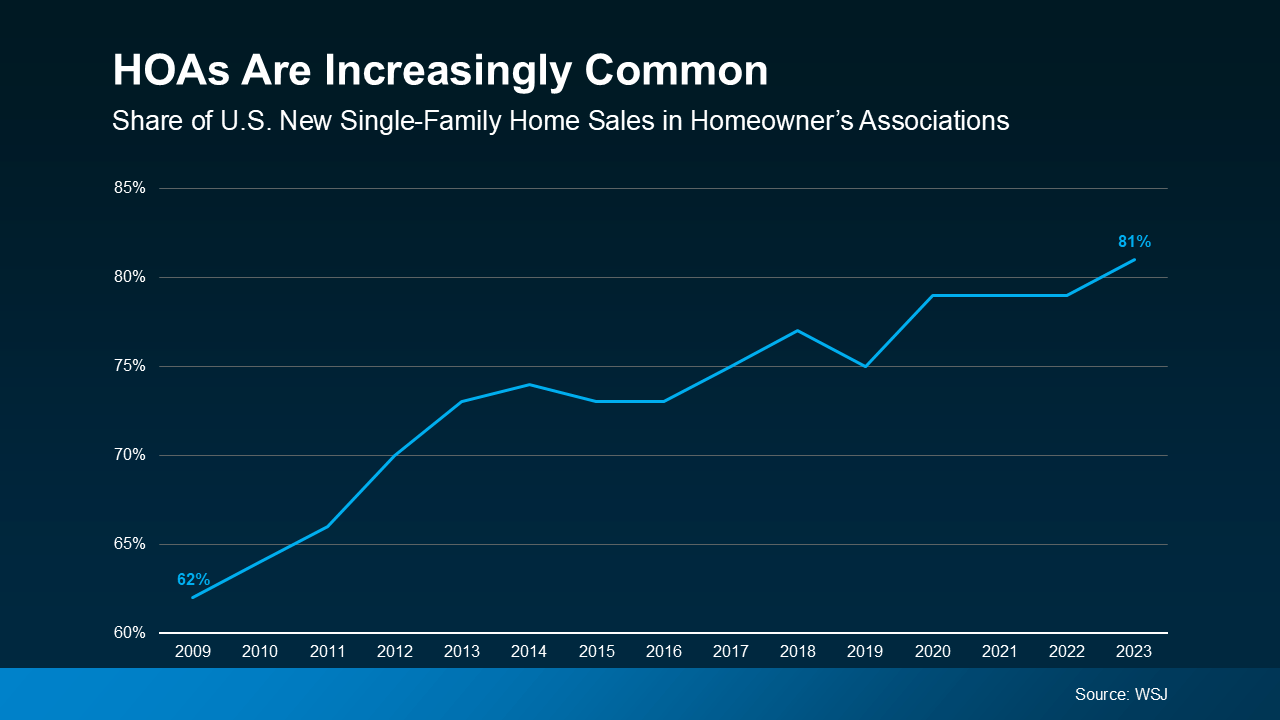

HOA Fees Are Becoming More Common

What to Ask During Your Home Search

-

Is there an HOA?

-

How much are the dues?

-

What do the fees cover?

The Takeaway

The information and opinions in this article are not investment advice. Tim Stice makes no guarantees about accuracy or completeness. Always do your own research and consult a professional before making financial decisions. Tim Stice is not liable for any loss or damage resulting from reliance on this content.

Tim Stice, Broker Realtor | Hawaii Life | Maui, Hawaii | Real Estate Agent