You’ve probably heard the phrase, “The best time to buy a home was yesterday. The next best time is today.” There’s a reason that saying has stood the test of time.

Even with higher mortgage rates and limited inventory, home values are still climbing steadily across the country. If you’re waiting for prices to drop or rates to improve, you might want to rethink that strategy—because waiting could end up costing you more.

Home Prices Are Still Rising

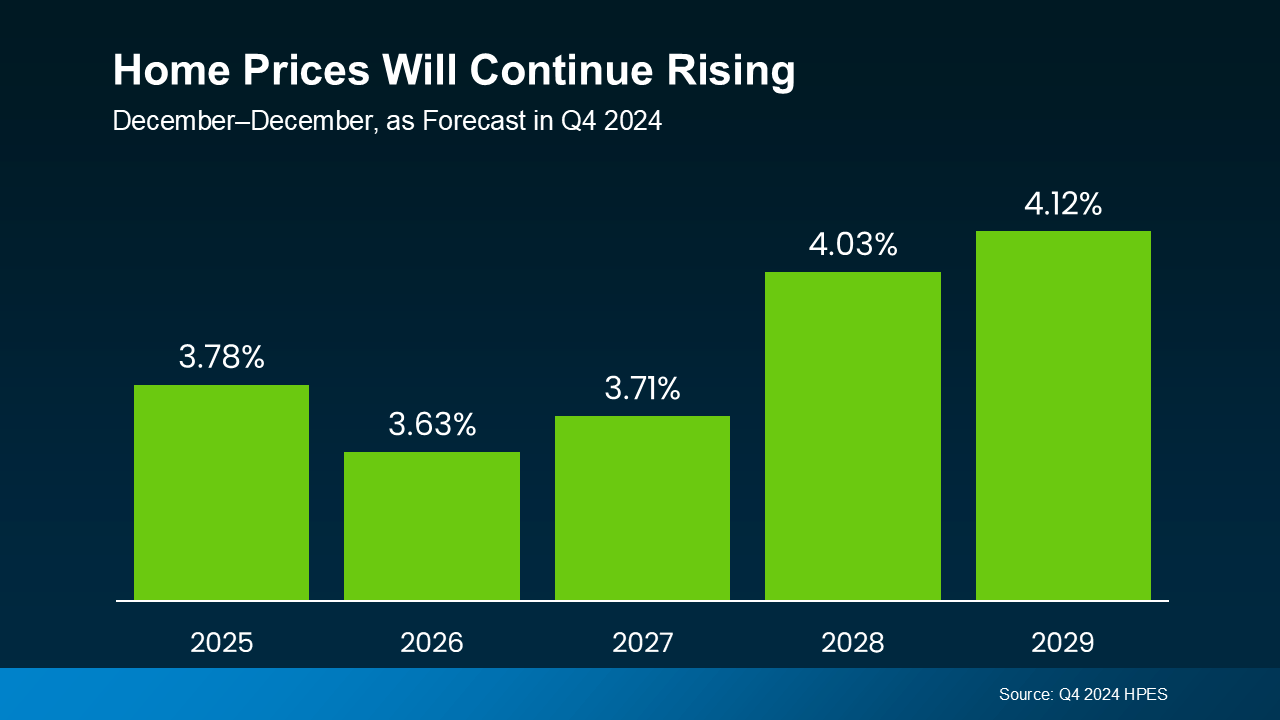

If you're hoping for a major drop in prices, experts say it’s not likely. Fannie Mae’s latest Home Price Expectations Survey shows that real estate prices are projected to keep increasing through at least 2029.

After the rapid spikes we saw in recent years, the market has cooled slightly—but home prices are still rising at a steady pace of about 3 to 4% annually. This kind of slow, predictable growth offers buyers more stability while still building long-term equity (see graph below):

Why Waiting Could Backfire

It’s tempting to sit on the sidelines and wait for interest rates or prices to dip. But here’s what you need to consider:

-

Prices are expected to keep going up.

The longer you wait, the more you might pay for the same home.

-

Trying to time the market is risky.

Even if rates drop, rising prices may cancel out any potential savings.

-

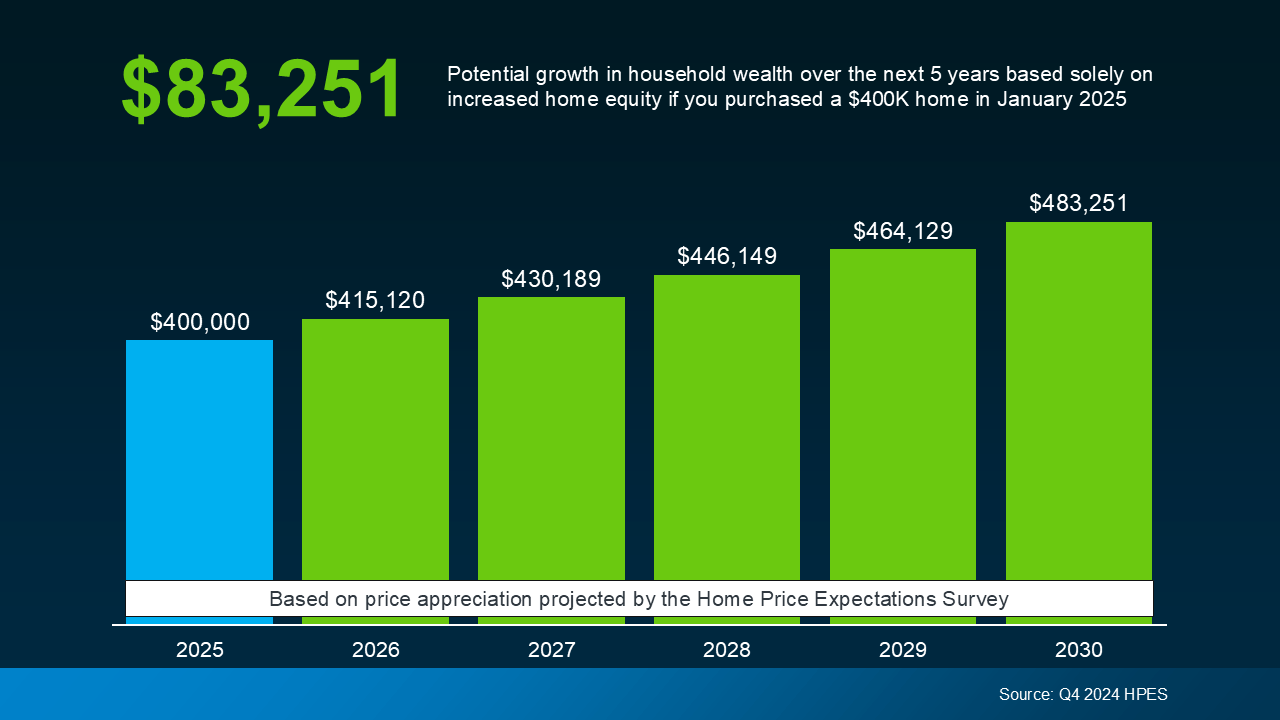

Buying now means building equity sooner.

For example, a $400,000 home today could be worth over $483,000 in five years based on current forecasts (see graph below):

Why Home Prices Aren’t Dropping

Inventory is slowly increasing, but demand still outweighs supply—and that’s keeping home prices elevated.. As Redfin explains:

"Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand."

So while some local markets may see prices flatten out briefly, a widespread decline in home values isn’t expected.

Bottom Line: Buying Sooner Could Pay Off

Perfect timing rarely works in real estate. The market tends to reward buyers who make informed decisions and act based on their own financial readiness—not those who wait for perfect conditions.

If you’re thinking about buying, there are plenty of strategies to help you make it work:

-

Look at different neighborhoods or property types

-

Consider condos or townhomes for affordability

-

Explore financing programs and down payment assistance

The important thing is to take the first step when it makes sense for you.

Thinking about buying a home?

Whether you’re ready now or still exploring options, I’d be happy to help you understand what’s happening in your local market and create a plan that fits your goals.

The information and opinions in this article are not investment advice. Tim Stice makes no guarantees about accuracy or completeness. Always do your own research and consult a professional before making financial decisions. Tim Stice is not liable for any loss or damage resulting from reliance on this content.

Tim Stice, Broker Realtor | Hawaii Life | Maui, Hawaii | Real Estate Agent