Are Home Prices Really Falling? Here's the Bigger Picture

You may have seen headlines talking about home prices dipping in some markets. If that has you second-guessing your plans, here’s what you really need to know.

It’s true—some metro areas are experiencing slight price declines. But don’t lose sight of the bigger picture:

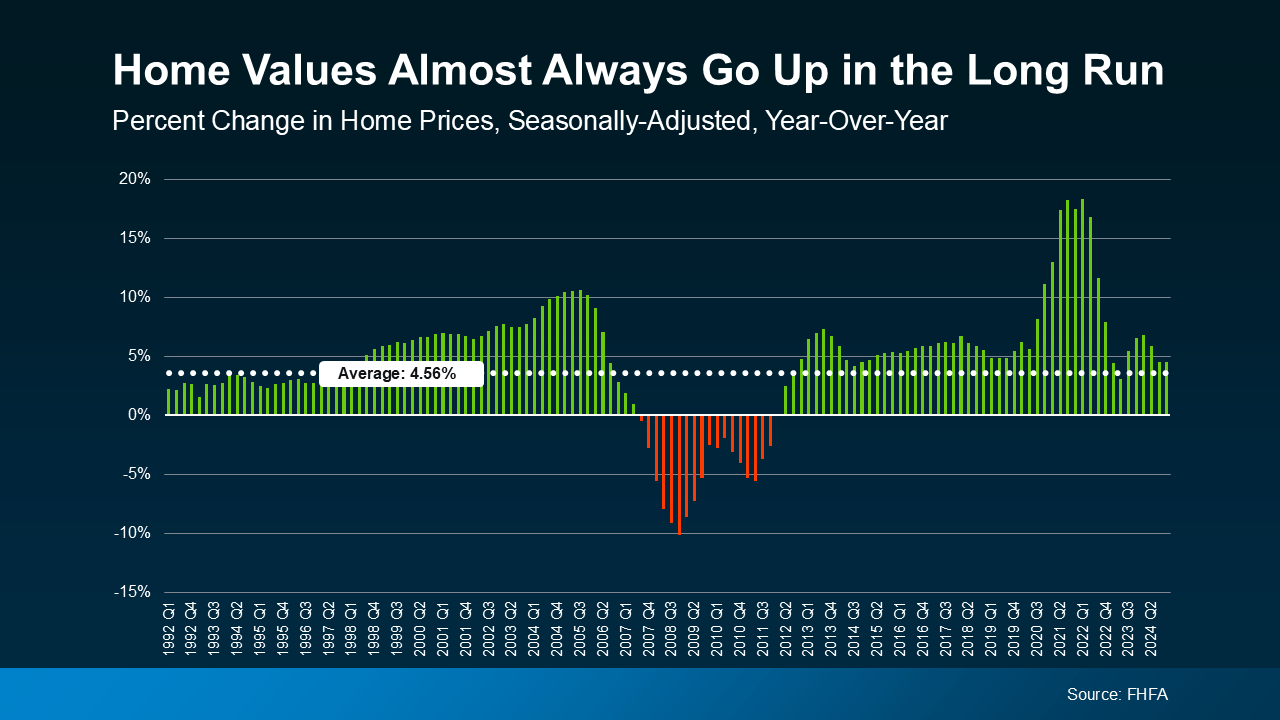

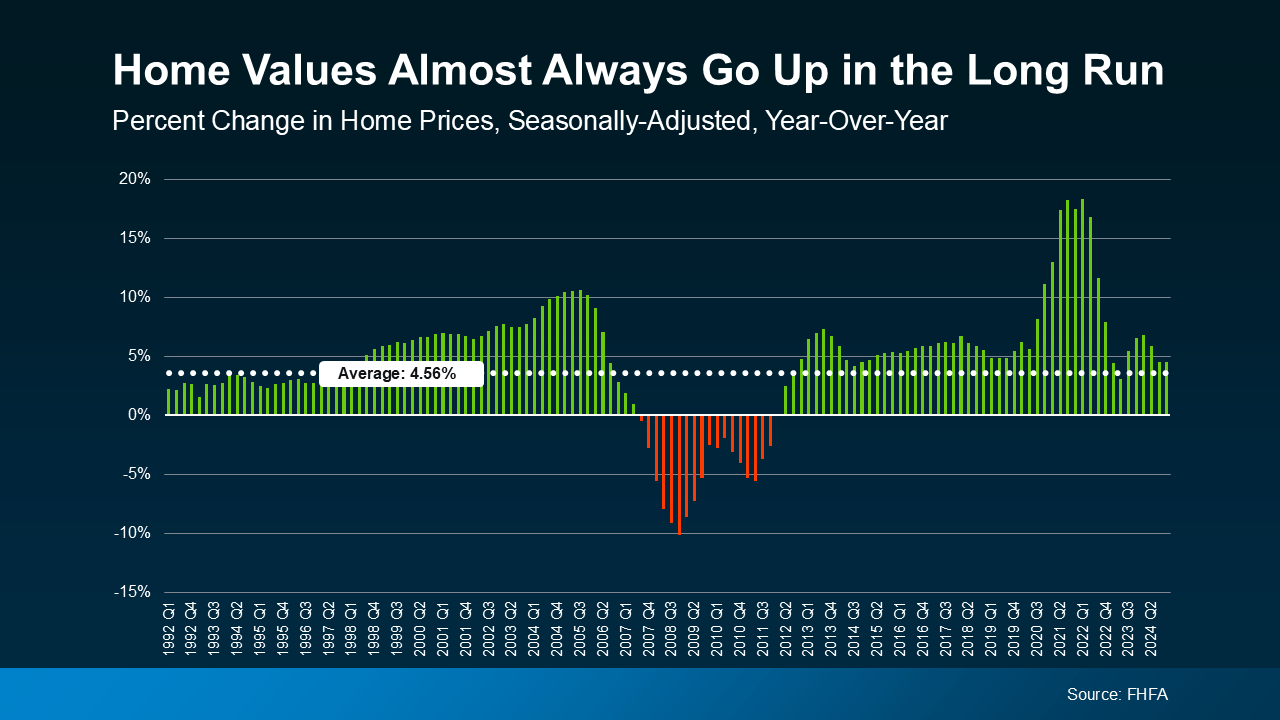

Home values tend to increase over time. See graph below:

Everyone remembers the housing crash of 2008, but that was an anomaly. Lending practices were looser, homeowners had less equity, and there was a surplus of inventory. Today’s market is nothing like that. So when you hear that prices are “normalizing” or “cooling off,” it doesn’t mean another crash is coming.

Why Short-Term Dips Aren’t the End of the World

Here’s a helpful way to think about it:

What’s the Five-Year Rule?

In real estate, there’s something called the five-year rule. It means that if you plan to stay in your home for at least five years, minor price dips usually don’t impact you much. That’s because home values almost always recover—and grow—over time.

Take it from Lance Lambert, Co-Founder of ResiClub:

“. . . there’s the ‘five-year rule of thumb’ in real estate—which suggests that most buyers can buffer themselves from mild short-term declines if they plan to own a property for at least that amount of time.”

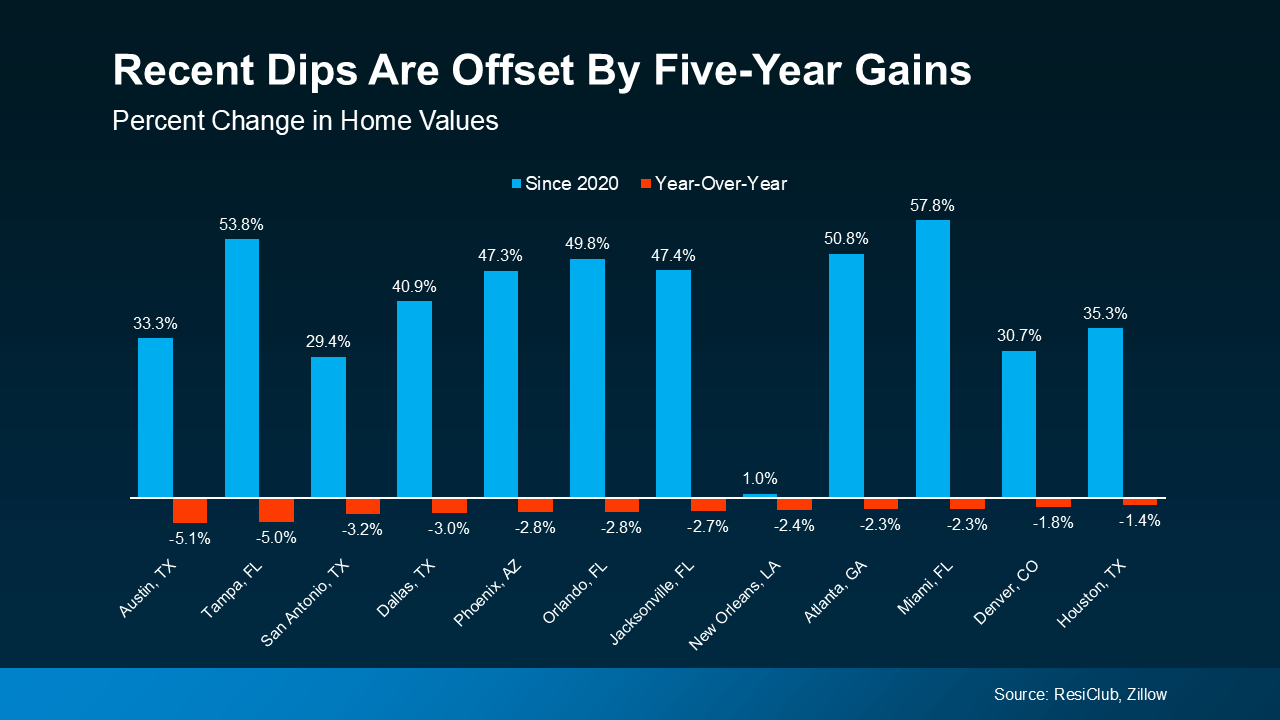

What the Market Looks Like Right Now

Most housing markets are still seeing price growth—just not as rapid as in previous years.

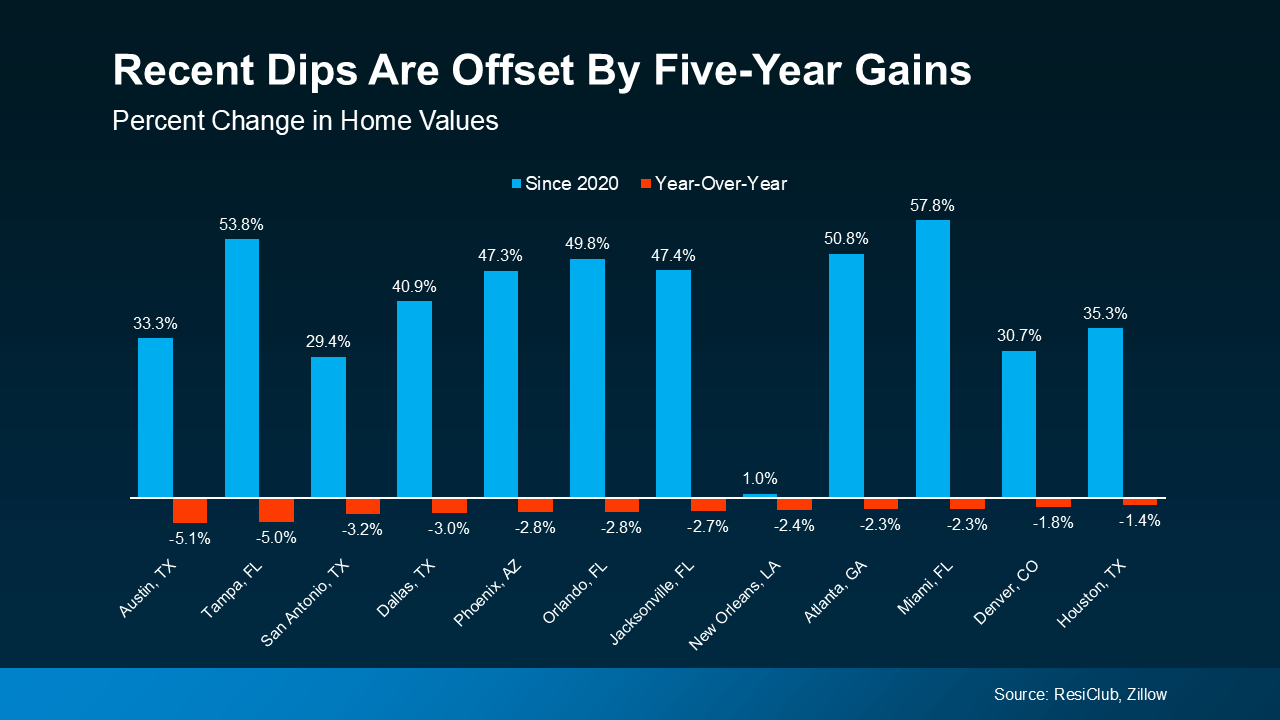

In a few major cities where prices are dipping slightly (shown in red on the graph below), the average decline is around -2.9% since April 2024. That’s minor compared to the drops seen during the 2008 crash.

But zoom out, and you’ll see something important:

Even in those cooling markets, home values are significantly higher than they were five years ago (shown in blue on the graph below). That means homeowners who bought before are still well ahead.

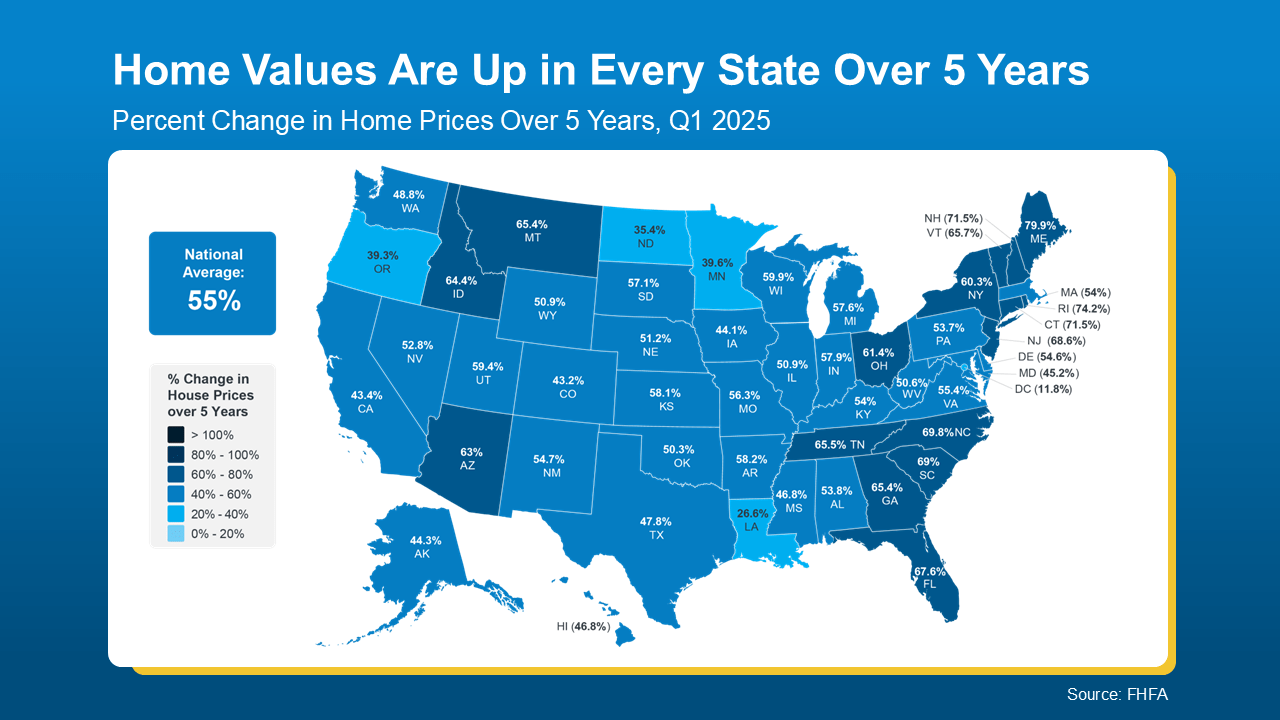

The Long-Term View Still Wins

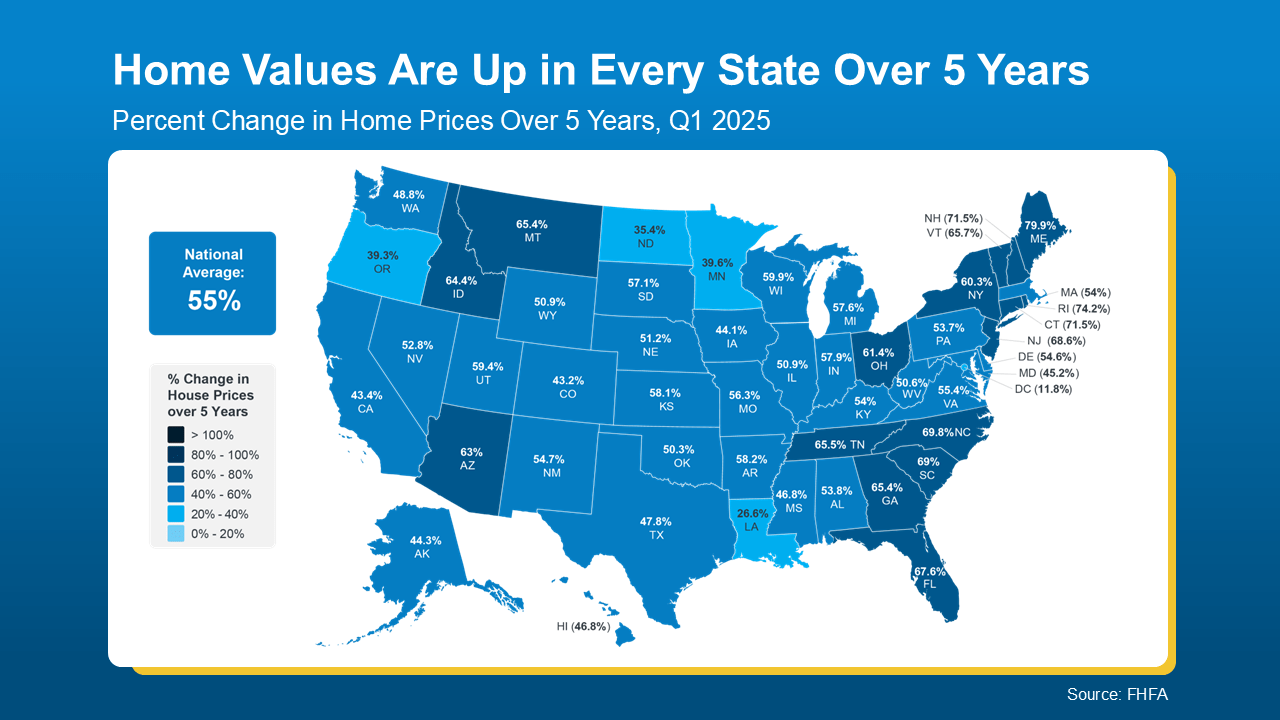

According to the Federal Housing Finance Agency (FHFA), home prices have gone up 55% over the last five years. So even if you see a small short-term dip, the long-term gains still outweigh it.

And it’s not just in a few states. The map below shows that every U.S. state has seen price growth in that time. (see map below):

So if you're planning to stay in your home long enough, short-term shifts don’t need to stress you out. The odds are still in your favor.

Bottom Line

Yes, prices may shift in the short term. But history shows home values almost always rise over time—especially if you plan to stay put for at least five years.

So the question isn’t just what the market is doing today. It’s:

Where do you want to be in five years—and how does owning a home fit into that vision?

Let’s connect and map out your next steps.

The information and opinions in this article are not investment advice. Tim Stice makes no guarantees about accuracy or completeness. Always do your own research and consult a professional before making financial decisions. Tim Stice is not liable for any loss or damage resulting from reliance on this content.

Tim Stice, Broker Realtor | Hawaii Life | Maui, Hawaii | Real Estate Agent