VA home loans have been supporting Veterans for 80 years, helping them achieve homeownership with fewer barriers. But despite how long this program has been around, many eligible Veterans still aren’t aware of one of its most valuable benefits.

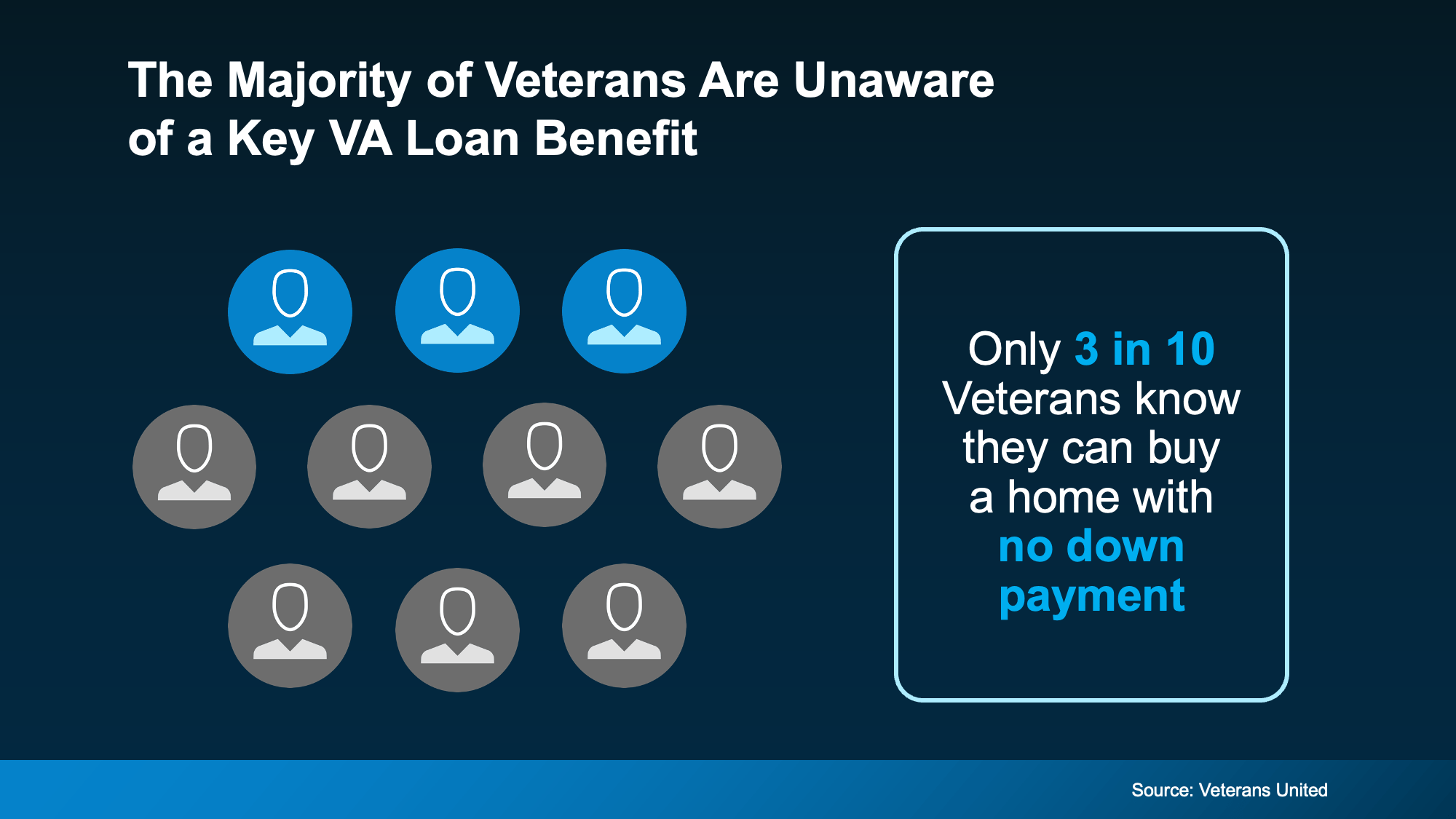

According to a report from Veterans United, only 3 in 10 Veterans know they may be able to buy a home with no down payment through the VA loan program.

That means 7 out of every 10 Veterans could be missing out on a key homebuying advantage.

If you’re a Veteran—or you know someone who is—this is something worth sharing. VA loans are a powerful tool designed specifically for those who have served, and as Veterans United puts it:

“. . . come with a list of big-time benefits, including $0 down payment, no mortgage insurance, flexible and forgiving credit guidelines and the industry's lowest average fixed interest rates.”

The Benefits of VA Home Loans

These loans are designed to make buying a home more achievable for those who have served. And, by extension, they also give their families the opportunity to plant roots and build equity in a home of their own. Here are some of the biggest advantages for this type of loan according to the

Department of Veterans Affairs:

- Options for No Down Payment: One of the biggest perks is that many Veterans can buy a home with no down payment at all.

- Limited Closing Costs: With VA loans, there are limits on the types of closing costs Veterans have to pay. This helps keep more money in your pocket when you’re finalizing your purchase.

- No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans don’t require PMI, even with lower down payments. This means lower monthly payments, which can add up to big savings over time.

Ready to Learn More?

If you're considering buying a home and think you might qualify for a VA loan, talk to a trusted local agent and lender. They’ll walk you through your options and help you make the most of the benefits you’ve earned.

Bottom Line

VA home loans can be life-changing—but only if Veterans know about them. If you’re eligible, make sure you understand your options and connect with a professional who can help you take the next step.

Not sure if you qualify for a VA loan? Speak with a trusted lender to find out today.

The information and opinions in this article are not investment advice. Tim Stice makes no guarantees about accuracy or completeness. Always do your own research and consult a professional before making financial decisions. Tim Stice is not liable for any loss or damage resulting from reliance on this content.

Tim Stice, Broker Realtor | Hawaii Life | Maui, Hawaii | Real Estate Agent