You’ve probably seen the headlines warning of a housing market crash. But when you look past the hype and into the actual data, the story is very different.

Yes, in some areas, prices are holding steady or dipping slightly as more listings come online. That’s a normal response to increased inventory—not a sign of collapse.

What really matters is the broader trend. And according to industry experts, it’s one of continued, sustainable growth.

What Over 100 Experts Say About Home Prices

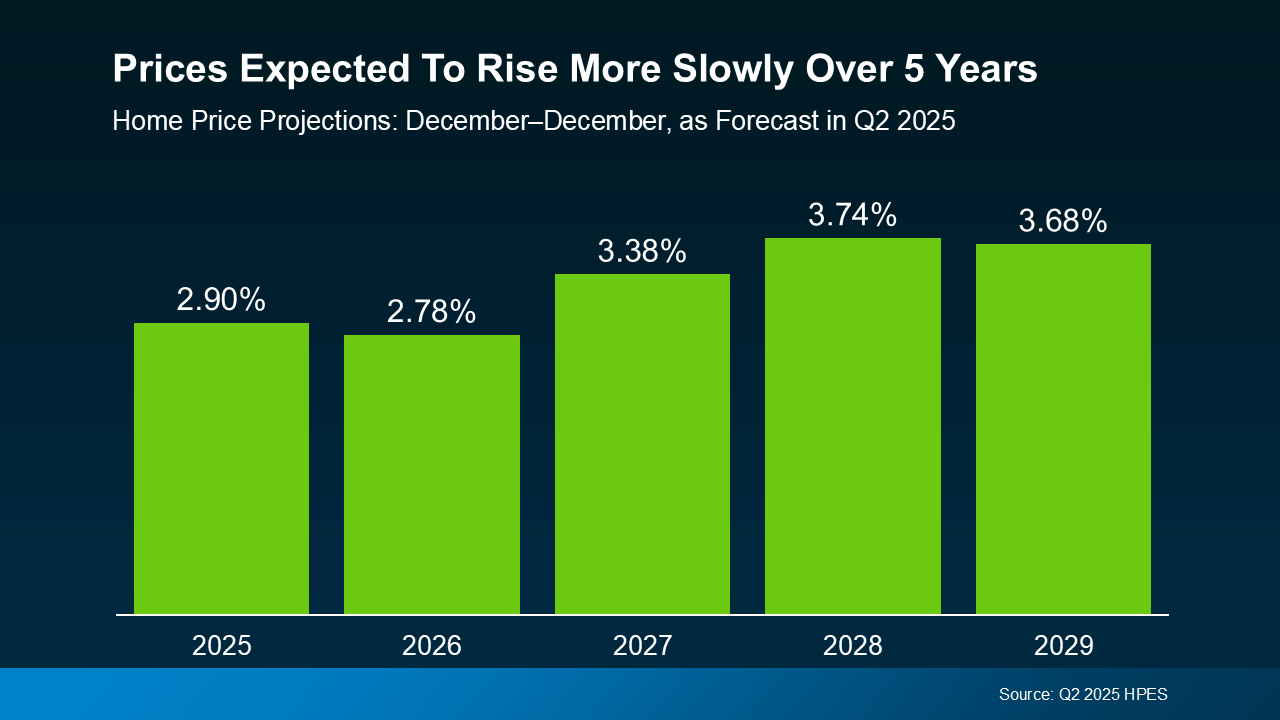

In the latest Home Price Expectations Survey (HPES) from Fannie Mae, over 100 housing economists and analysts shared where they believe home values are headed over the next five years.

Their forecast? Home prices are projected to keep rising, just at a more moderate pace.

And that kind of steady, sustainable growth should be one factor to help ease your fears about the years ahead. (see graph below):

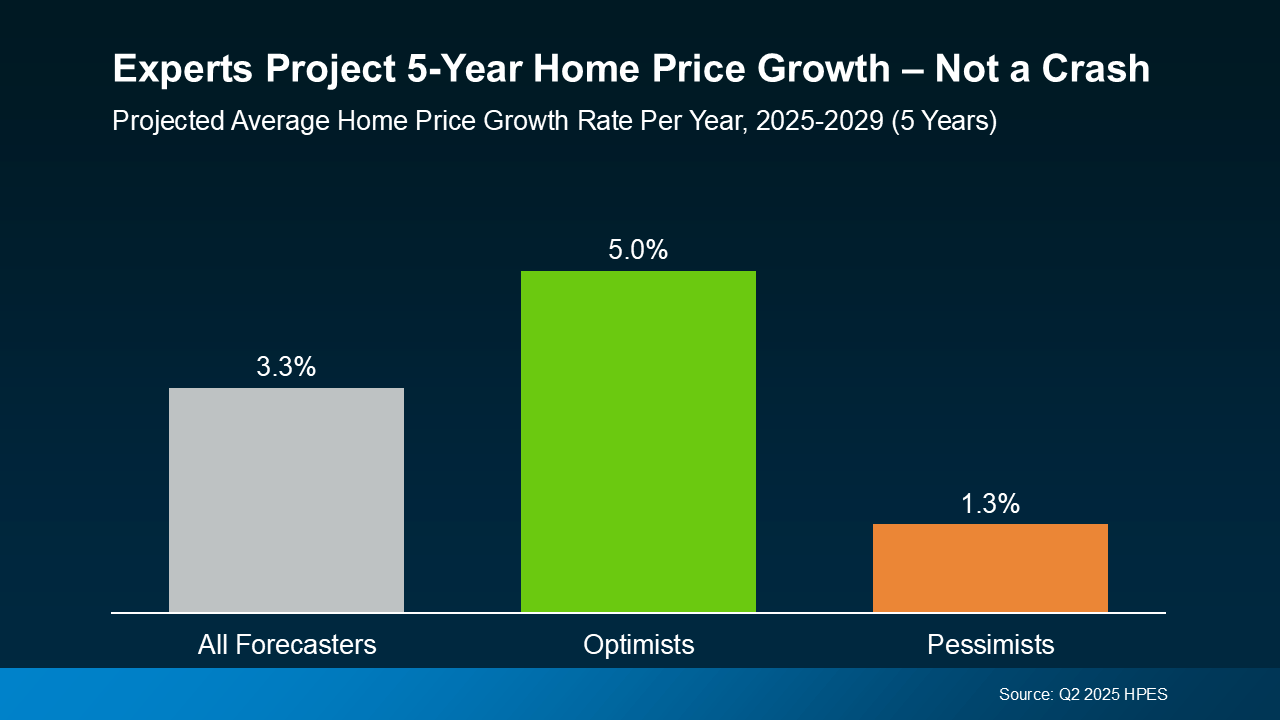

And if you take a look at how the various experts responded within the survey, they fall into three main categories: those that were most optimistic about the forecast, most pessimistic, and the overall average outlook.

Here’s what the breakdown shows:

- Average forecast: About 3.3% annual home price growth through 2029

- Optimistic projections: As high as 5.0% per year

- Pessimistic estimates: Still a positive 1.3% annual increase

Not one expert group is predicting a housing crash. Even the most conservative forecasts still expect prices to rise year over year.

What This Means for You

A steady price increase means the market is stabilizing. After the sharp spikes we saw during the frenzy of the past few years, this kind of growth is a good sign.

-

If you’re buying: It’s time to stop waiting for a crash that’s not coming. Home prices are expected to keep climbing.

-

If you’re selling: Your equity is likely secure and still growing. Listing now may put you in a strong position.

Some markets may remain flat in the short term, especially where inventory is up. Others may outpace the national average if demand remains high and supply stays low. But across the board, there’s no expectation of widespread declines.

Why the Market Isn’t Headed for a Crash

Here’s what’s keeping the housing market strong:

-

Foreclosures remain historically low

-

Lending standards are still tight

-

Homeowners are sitting on near-record levels of equity

These factors help prevent a flood of forced sales that could drag prices down—one of the key drivers of past housing crashes. Even the most cautious analysts agree: the foundation of the market today is solid.

Bottom Line

Despite what the headlines say, the market isn’t collapsing. It’s moving toward balance.

Experts expect home prices to rise slowly and steadily over the next five years. So if you’re holding off on your next move, waiting for prices to drop dramatically—you might be waiting a long time.

Want to know what this means for your local neighborhood?

Let’s connect. I’ll show you exactly how these national trends are playing out in our market.

The information and opinions in this article are not investment advice. Tim Stice makes no guarantees about accuracy or completeness. Always do your own research and consult a professional before making financial decisions. Tim Stice is not liable for any loss or damage resulting from reliance on this content.

Tim Stice, Broker Realtor | Hawaii Life | Maui, Hawaii | Real Estate Agent