Are you wondering whether you’re truly on track for retirement?

According to Intuit, 69% of people say today’s financial environment makes it hard to plan ahead, and 68% aren’t sure they’ll ever be able to retire. That’s why more people are looking beyond traditional savings to create long-term stability and income.

One strategy that’s gaining traction: investing in a second home.

Why Real Estate Could Be the Missing Piece

If the numbers make sense for you, buying a second home can be a powerful part of your retirement strategy. Here’s how it can help:

-

Build wealth over time: As property values increase, your second home builds equity and boosts your net worth.

-

Generate income: Renting the home can provide extra cash flow to add to your retirement savings. Keep in mind some of that income goes toward the mortgage and upkeep.

-

Future profit: Selling the second home later could give your retirement funds a strong boost.

-

Diversify your assets: Real estate provides a tangible investment that adds balance to your portfolio, beyond stocks or cash savings.

Who’s Really Buying Multiple Homes?

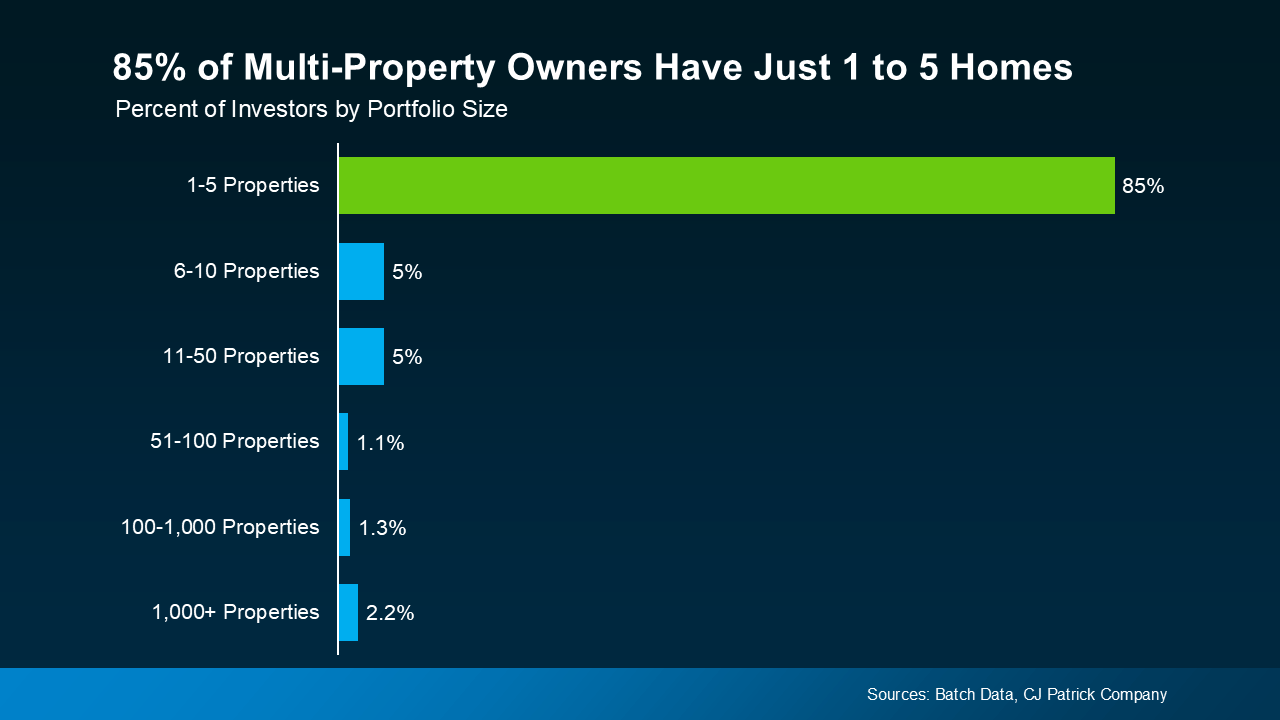

If you’re thinking second homes are only for big investors, the data tells a different story. Most people who own more than one property are everyday homeowners, not large corporations.

In fact, data from

BatchData and

CJ Patrick Company shows

85% of people who own more than one property have just 1 to 5 homes (

see graph below):

That means a second home isn’t just for large-scale investors—it’s for people like your neighbors who want to rent out an extra property or hold onto it for future gains.

Why Now Could Be a Smart Time to Buy

Today’s housing market is presenting new opportunities for buyers. As Danielle Hale, Chief Economist at Realtor.com, explains:

“. . . the balance of power in the housing market keeps shifting in favor of homebuyers. . . A confluence of factors—including more homes for sale, rising price cuts, and slower-moving inventory—is giving buyers more leverage than they've had in years . . .”

If you live in or are eyeing an area where home prices are projected to rise, purchasing a second home now could set you up for significant future profit. Or, you could rent it out right away and enjoy ongoing income.

Start with the Right Team

If the idea of a second home sparks your interest, the smartest move is to surround yourself with trusted professionals:

That’s where I come in. As a Maui real estate agent, I help buyers navigate opportunities like these every day. With the right strategy, we can find a property that not only fits your lifestyle now but also supports your future.

Bottom Line

A second home could be more than just a place to enjoy—it could be the key to a stronger, more flexible retirement.

If you’re curious whether this move makes sense for you, let’s talk. Together, we’ll explore whether a second home can give you the security, income, and peace of mind you want for the years ahead.

The information and opinions in this article are not investment advice. Tim Stice makes no guarantees about accuracy or completeness. Always do your own research and consult a professional before making financial decisions. Tim Stice is not liable for any loss or damage resulting from reliance on this content.

Tim Stice, Broker Realtor | Hawaii Life | Maui, Hawaii | Real Estate Agent