If retirement is approaching, it's the perfect moment to start envisioning your next chapter. You probably want to ensure you’re financially prepared to enjoy the lifestyle you've imagined.

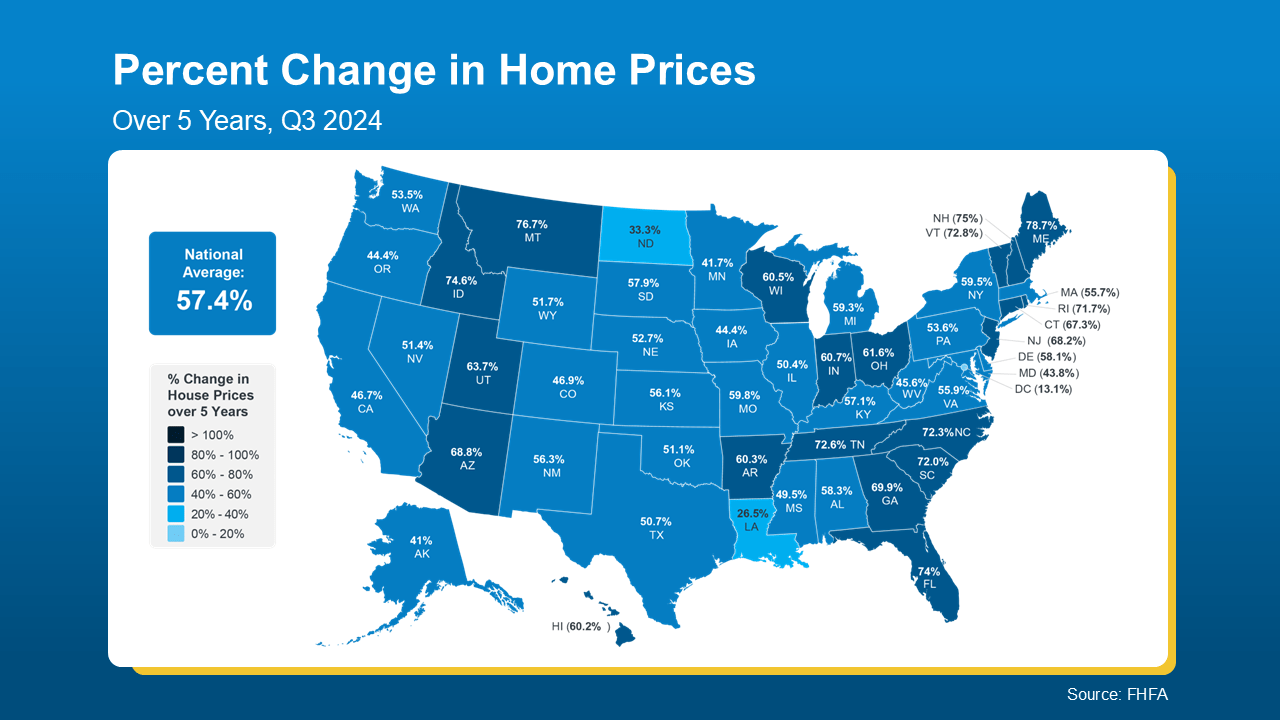

You might be surprised to learn that you’re sitting on a hidden asset you might not fully appreciate—your home. According to the Federal Housing Finance Agency (FHFA), home values have risen nearly 60% in the past five years alone (see graph below):

This appreciation significantly increased your net worth. Freddie Mac reports that during the same five-year period:

“ . . . Boomer overall wealth increased by $19 trillion, or $486,000 per household, half of which is due to house price appreciation.”

If you’ve owned your home for even longer, it’s likely your equity is even greater. To tap into this wealth you've built over time, selling your home and downsizing could be a smart move.

Why Downsizing Could Be a Smart Choice

Selling your current home and moving to a smaller place or a more affordable location can free up your equity, giving you financial freedom and confidence in retirement. Whether your retirement dreams include travel, family time, or simply financial peace of mind, accessing your home equity could make those goals a reality. As Chase says:

“Retirement is an exciting time. Selling your home to take advantage of the equity or to downsize to a more affordable home can open up additional options for your future.”

Here are three significant benefits of downsizing:

1. Reduce Your Living Expenses

AARP data indicates that reducing costs is the primary reason adults aged 50 and older choose to move. Downsizing can lower monthly expenses such as utilities, property taxes, and maintenance.

2. Enjoy a Simpler Lifestyle

A smaller home generally means less maintenance and fewer responsibilities, freeing your time and energy to pursue what truly matters to you during retirement.

3. Increase Financial Flexibility

Selling your home converts your equity into accessible cash. This money can then be used for investing, clearing debts, or creating an additional financial safety net, providing new opportunities for your retirement.

Getting Started

If downsizing sounds appealing, your first step is connecting with a real estate agent. Your agent will assess your home equity, explore how it can benefit you, and guide you through the selling and buying process. This support ensures a smooth transition into your new home and lifestyle.

Bottom Line

Planning to retire in 2025? Downsizing now could help you unlock substantial home equity, paving the way for a fulfilling and financially secure retirement. Let’s get started, so every day feels like a Saturday.

The information and opinions in this article are not investment advice. Tim Stice makes no guarantees about accuracy or completeness. Always do your own research and consult a professional before making financial decisions. Tim Stice is not liable for any loss or damage resulting from reliance on this content.

Tim Stice, Broker Realtor | Hawaii Life | Maui, Hawaii | Real Estate Agent