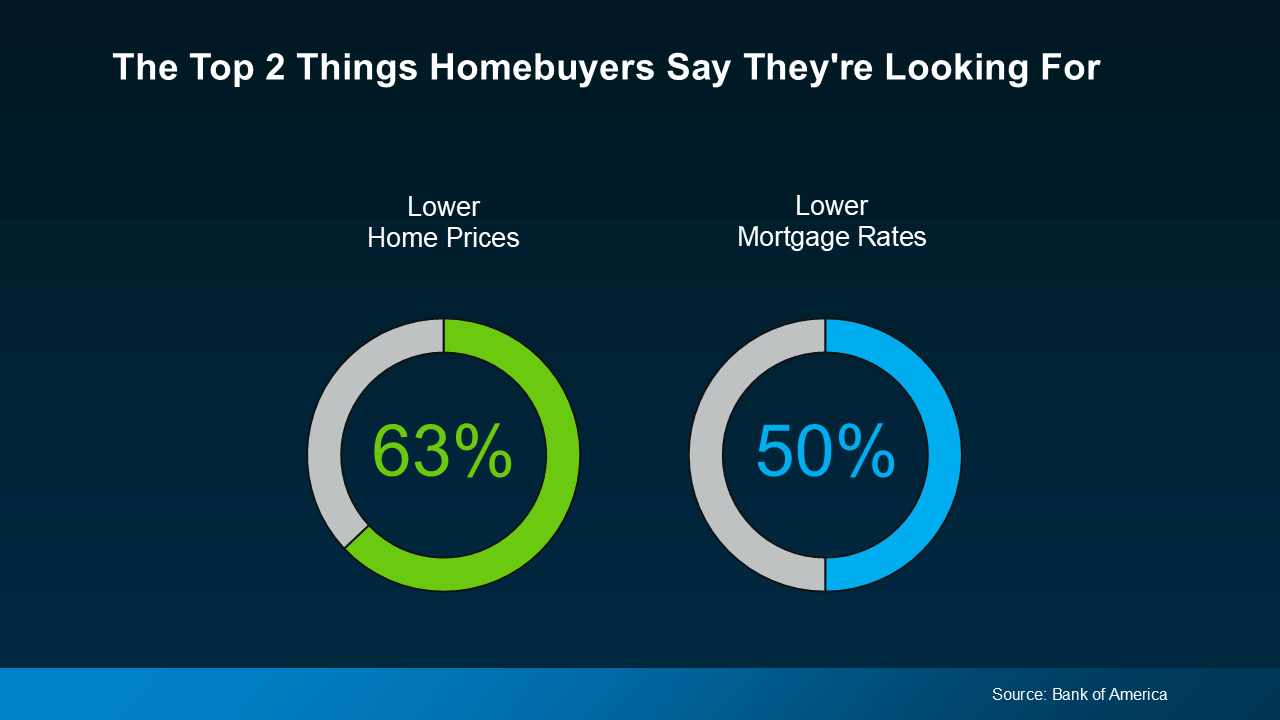

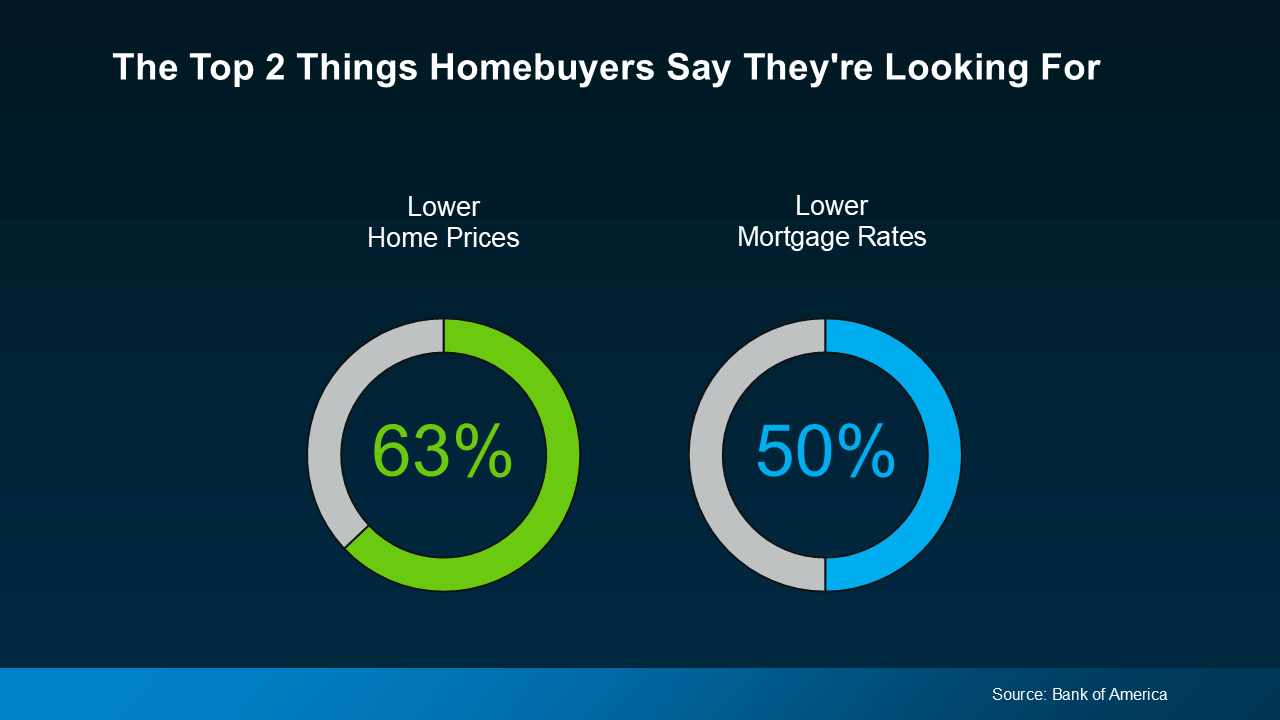

A recent

survey from

Bank of America asked potential buyers what would help them feel more confident about moving forward. The results? Affordability is at the top of their list, especially when it comes to home prices and mortgage rates (

see below):

The encouraging news is that while the broader economy still feels uncertain, there are clear signs that housing conditions are shifting in ways that could benefit buyers. Here’s a closer look.

Prices Are Moderating

In recent years, home values climbed quickly, leaving many buyers feeling priced out. For example, from 2020 to 2021, prices jumped

20% in a 12-month period. Now? Nationally, experts are projecting single-digit increases this year – a much more normal pace.

Now, things look different. Nationally, experts are forecasting single-digit gains this year; a far more typical pace. That’s a sharp contrast to the double-digit surges we saw just a few years ago.

Of course, price trends vary by location. Some areas may continue to see growth, while others could level off or dip slightly. But overall, the market is no longer moving at breakneck speed, which makes budgeting and planning more manageable for buyers.

Mortgage Rates Are Easing

Rates have also come down from their recent highs, easing some of the pressure on buyers. As Lisa Sturtevant, Chief Economist at Bright MLS, explains:

“Slower price growth coupled with a slight drop in mortgage rates will improve affordability and create a window for some buyers to get into the market.”

Even small shifts in mortgage rates can have a big impact on monthly payments. While rates are likely to fluctuate in the months ahead, the overall outlook is more stable. Most experts expect them to hover in the low-to-mid 6% range this year, which is a noticeable improvement compared to just a few months ago. Depending on broader economic factors, there’s even potential for further declines.

What This Means for Buyers

Confidence in the economy may be mixed, but the housing market is showing signs of adjustment. With prices slowing and rates edging down, buyers are getting a little more breathing room.

That doesn’t erase affordability challenges entirely, but it does mean conditions look different than they did earlier this year. These changes may give more buyers an opening to re-enter the market in the months ahead.

Bottom Line

The top concerns for buyers, prices and rates, are both shifting in a positive way. As we move closer to 2026, those improvements may continue.

If you are thinking about making a move, let’s connect. I will walk you through what is happening in Maui’s market and what it could mean for your next steps.

The information and opinions in this article are not investment advice. Tim Stice makes no guarantees about accuracy or completeness. Always do your own research and consult a professional before making financial decisions. Tim Stice is not liable for any loss or damage resulting from reliance on this content.

Tim Stice, Broker Realtor | Hawaii Life | Maui, Hawaii | Real Estate Agent

The encouraging news is that while the broader economy still feels uncertain, there are clear signs that housing conditions are shifting in ways that could benefit buyers. Here’s a closer look.

The encouraging news is that while the broader economy still feels uncertain, there are clear signs that housing conditions are shifting in ways that could benefit buyers. Here’s a closer look.